tax strategies for high income earners australia

Take Home Rates for an annual income of 400000. A range of both basic and advanced tax strategies and investment options can be explored to this end.

Tax Reform Welcome But More To Do Betashares

Tax Strategies For High Income Individuals How to reduce taxable income for high earners.

. This video gives a few suggestions on how to reduce taxable income. With the Medicare levy already legislated to increase from 15 to 2 from 1 July 2014 the rise in levies will effectively be 25 for. If you are among them then you shall definitely need guidance and support from experienced tax accountants and CPA accountants.

August 12 2014. Additionally tax-deferred accounts benefit by compounding returns faster by sheltering income from current taxation. That can help you leave behind a larger financial legacy for your loved ones through your estate plan.

Australia overtaxes high wage income earners relatively speaking. User 552406 11075 posts. Join Australias most dynamic and respected property investment community.

So a banker doctor making 1m. In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. Tax reduction strategies for high income earners australia Thursday March 10 2022 Edit.

Tax reduction strategies for high income earners australia Tuesday March 1 2022 Edit. Australia overtaxes high wage income earners relatively speaking. The higher your tax bracket the higher the benefits are of tax savings.

Take Home Rates for an annual income of 400000. Just as it sounds this option allows high earners to bypass the income limits and still utilize the tax advantages of a. In australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to consider some planning strategies to lessen the impact. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities.

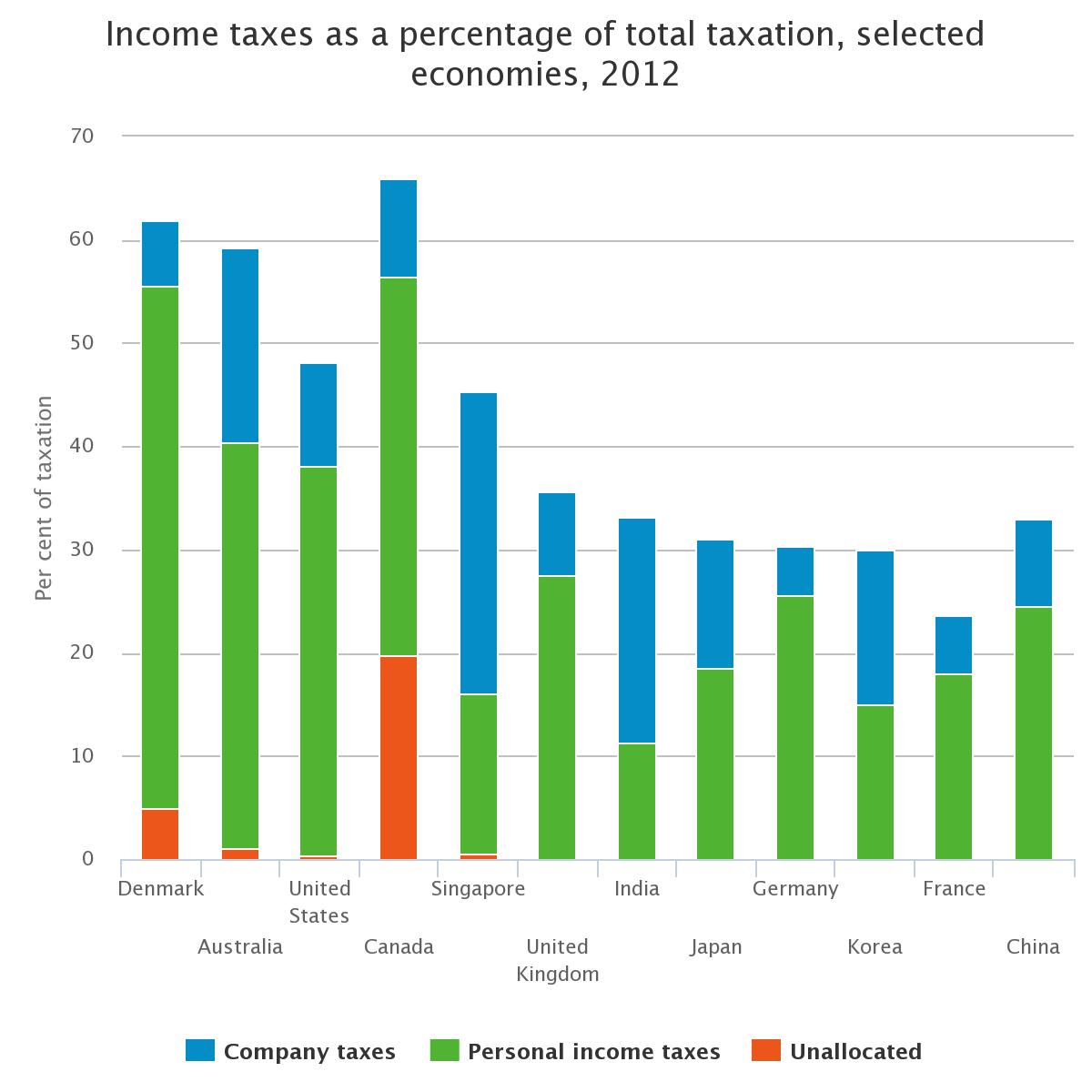

Keep in mind that the ATO keeps a strict watch over the high-income earners and there is no way for you to escape. Our highest marginal income tax rate kicks in at around 2x average earnings vs about 4x in most other countries and the rate of 47 is not low. According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners.

Income splitting and trusts. Proposed Tax Changes For High Income Individuals Ey Us Home Oecd Ilibrary. Implementing the Tax minimization strategies is the prime lookout for every high-income earner in Hobart.

The federal income tax is designed to tax higher levels of income at higher tax rates. Appropriate types and amounts of insurance cover. By implementing tax strategies for high-income earners you can preserve more of your earnings and wealth over time.

Careful tax planning always matters but when you have a higher net worth doing everything right can be even more essential. If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA. Different strategies for high income earners Discussion in Investment Strategy started by Kramerica12 7th Apr 2020.

Australia Current Situation In Control Strategies And Health System The Most Tax Efficient Company Structures To Reduce Tax Burdens Wealth Safe. TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA. Home australia high reduction strategies.

Given that most are employed in specialist occupations this takes greater time and a more detailed investigation to ensure that cover is appropriate for your circumstances. Asset and debt structuring can be key to. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

What Is Considered A High Income Earner In Australia Ictsd Org

Australian Income Tax Brackets And Rates For 2021 And 2022

How Do High Income Earners Reduce Taxes In Australia

How Do High Income Earners Reduce Taxes In Australia

What Is Considered A High Income Earner In Australia Ictsd Org

How Do High Income Earners Reduce Taxes In Australia

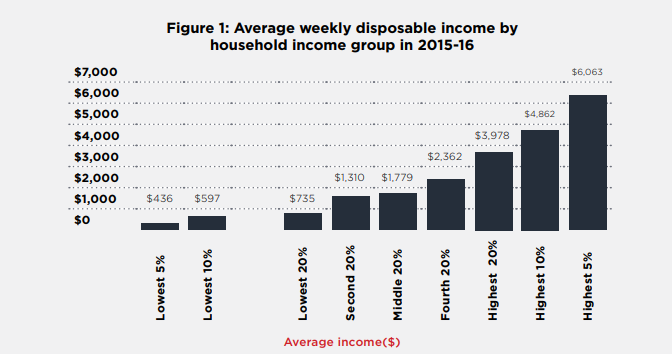

Inequality In Australia 2018 Html Acoss

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

Tax Reform Welcome But More To Do Betashares

How Do High Income Earners Reduce Taxes In Australia

How To Pay Less Taxes For High Income Earners Wealth Safe

How To Pay Less Taxes For High Income Earners Wealth Safe

If You Re A Younger Worker In Australia Don T Be Fooled On Tax Cuts Greg Jericho The Guardian

How To Pay Less Taxes For High Income Earners Wealth Safe

![]()

How Do High Income Earners Reduce Taxes In Australia

Advanced Tax Strategies For High Income Earners In Australia Solve Accounting

Tax Minimisation Strategies For High Income Earners

How Do High Income Earners Reduce Tax In Australia Imagine Accounting